Understanding India’s tax system doesn’t have to feel like decoding Panini’s Sanskrit Grammar. This comprehensive guide will change you from someone who dreads the mention of “Indian Tax System” to a confident, tax-savvy individual.

The truth is, most of us stumble through our tax *duties like we’re walking through a maze in the dark. We hear terms like “80C” and “taxable income” thrown around in casual workplace conversations, nod knowingly while internally panicking, and then secretly Google them later in the privacy.

The Foundation: How Income Tax Works in India

Income tax in India operates on what’s called a progressive slab system, which is essentially a fancy way of saying “the more you earn, the higher percentage the government takes.” This system is designed to ensure that those who can afford to contribute more to the nation’s development do so, while providing relief to lower-income earners.

Here’s how it actually works in practice: if you earn ₹6 lakh annually, you don’t pay 20% tax on the entire amount. Instead, you pay nothing on the first ₹2.5 lakh (that’s your basic exemption), 5% on the next ₹2.5 lakh (from ₹2.5 to ₹5 lakh), and 20% only on the remaining ₹1 lakh. This graduated approach means your effective tax rate is always lower than the highest slab you fall into – a concept that confuses many first-time taxpayers.

Current Income Tax Slabs (Old Regime)

The old tax regime, which has been the backbone of Indian taxation for decades, offers numerous deductions and exemptions but comes with higher basic tax rates. For individuals below 60 years of age, here’s how your income gets taxed:

- Up to ₹2.5 lakh: Completely tax-free (0%) – This is your basic exemption limit, meaning every Indian gets to earn this much without paying a single rupee in income tax. It’s the government’s way of ensuring basic necessities remain affordable.

- ₹2.5 lakh to ₹5 lakh: 5% tax – This relatively gentle introduction to taxation affects the lower-middle-class significantly, as even this 5% can feel substantial when you’re just crossing the tax threshold.

- ₹5 lakh to ₹10 lakh: 20% tax – This is where most young professionals find themselves, and where tax planning becomes crucial. A ₹6 lakh salary puts you in this bracket, but smart planning can significantly reduce your actual tax burden.

- Above ₹10 lakh: 30% tax – The highest individual tax slab, plus additional surcharges and cess for very high earners. Once you cross ₹50 lakh, you enter surcharge territory with additional levies.

What many people don’t realize is that these rates are applied only to the income falling within each slab. So if you earn ₹6 lakh, your tax calculation would be: ₹0 on first ₹2.5 lakh + ₹12,500 (5% of ₹2.5 lakh) + ₹20,000 (20% of ₹1 lakh) = ₹32,500 total tax before any deductions.

New Tax Regime (Updated for FY 2025-26)

MAJOR UPDATE – Budget 2025: The government has dramatically transformed the new tax regime for FY 2025-26, making it significantly more attractive for middle-income earners. This represents the most substantial tax relief for the middle class in recent years.

Under the revised new regime for FY 2025-26, the tax slabs for individuals below 60 years are:

- Up to ₹4 lakh: No tax (0%) – Increased from ₹3 lakh, providing immediate relief to 4+ crore taxpayers.

- ₹4 lakh to ₹7 lakh: 5% tax – Restructured bracket providing better progression.

- ₹7 lakh to ₹10 lakh: 10% tax – Intermediate rate for gradual progression.

- ₹10 lakh to ₹12 lakh: 15% tax – New intermediate slab.

- ₹12 lakh to ₹15 lakh: 20% tax – Narrower band at 20% rate.

- Above ₹15 lakh: 30% tax – Top rate now kicks in at ₹15 lakh instead of ₹12 lakh.

Revolutionary Change: The rebate under Section 87A has been increased from ₹25,000 to ₹60,000 for the new regime. Combined with the new slabs, this makes the entire tax liability NIL for incomes up to ₹12 lakh. For salaried employees with the standard deduction of ₹75,000, effective tax-free income reaches ₹12.75 lakh.

Updated Pro Tip (Budget 2025): The equation has completely changed! With income up to ₹12 lakh now being tax-free under the new regime, most professionals earning between ₹6-15 lakh will find the new regime more beneficial, even without any deductions. The old regime now only makes sense if you have substantial deductions exceeding ₹3-4 lakh annually (typically high home loan EMIs, maximum 80C, substantial HRA, etc.). Always calculate both scenarios, but expect the new regime to win for the majority of taxpayers.

Understanding Gross vs. Taxable Income

One of the biggest sources of confusion for new taxpayers is understanding why their salary slip shows one amount (gross income) but they pay tax on a much smaller amount (taxable income). This difference is where the real magic of tax planning happens, and understanding it thoroughly can save you substantial money.

Here’s how the journey from gross to taxable income works:

- Gross Income: This is the total of everything your employer pays you – basic salary, HRA, special allowances, bonuses, overtime payments, perquisites, and any other monetary benefits. It’s the big, impressive number at the top of your salary slip that makes you feel wealthy until reality hits.

- Exemptions: These are specific portions of your income that the government has decided should not be taxed at all, provided you meet certain conditions. HRA (if you actually pay rent), LTA (for domestic travel), meal vouchers (up to ₹2,200 per month), and various allowances fall into this category. The key word here is “conditions” – these exemptions aren’t automatic.

- Deductions: Unlike exemptions, deductions are amounts you can subtract from your taxable income based on specific investments, expenses, or contributions you make. Section 80C investments, health insurance premiums under 80D, and home loan interest under Section 24 are classic examples. These require active planning and actual financial commitments on your part.

- Taxable Income: This is what remains after subtracting all eligible exemptions and deductions from your gross income. This is the amount on which your actual tax liability is calculated using the applicable slabs.

To illustrate this with a real-world example: Let’s say Priya earns ₹8 lakh gross annually, receives ₹2 lakh HRA (of which ₹1.5 lakh is exempt), invests ₹1.5 lakh in 80C instruments, and pays ₹25,000 in health insurance premiums. Her taxable income becomes: ₹8,00,000 – ₹1,50,000 (HRA exemption) – ₹1,50,000 (80C) – ₹25,000 (80D) = ₹4,75,000. Instead of paying tax on ₹8 lakh, she pays tax on less than ₹5 lakh – a massive difference in tax liability.

Section 80C: Your Tax-Saving Superhero

If the Indian tax code had a hall of fame, Section 80C would be the undisputed champion, the Sachin Tendulkar of tax savings. This provision has probably saved more money for more taxpayers than any other section of the Income Tax Act. It’s like a discount coupon that the government gives you, allowing you to reduce your taxable income by up to ₹1.5 lakh annually – which translates to tax savings of up to ₹46,800 if you’re in the highest 30% tax bracket.

But here’s what makes Section 80C truly brilliant: it’s not just about saving taxes today. Most 80C investments are designed to build long-term wealth, meaning you’re essentially getting paid by the government to secure your financial future. It’s a rare win-win situation where doing the right thing for your future also reduces your current tax burden.

What Qualifies Under Section 80C?

The beauty of Section 80C lies in its remarkable flexibility – the government has recognized that people have different financial goals, risk appetites, and life circumstances, so they’ve provided multiple avenues to claim this deduction. Here’s your comprehensive menu of options:

Traditional Investment Options

- Employee Provident Fund (EPF): This is the most effortless 80C investment since it’s automatically deducted from your salary. Your contribution (12% of basic salary) qualifies for 80C deduction, and many people exhaust a significant portion of their 80C limit through EPF alone. The beauty of EPF is that it’s forced savings with decent returns (currently around 8.5% annually) and complete safety.

- Public Provident Fund (PPF): Often called the “gold standard” of tax-saving investments, PPF offers a unique triple benefit – tax deduction on investment, tax-free returns during the tenure, and tax-free withdrawal after 15 years. With current returns around 7.1% annually and complete government backing, PPF is ideal for ultra-conservative investors and long-term retirement planning.

- Equity Linked Savings Schemes (ELSS): These are mutual funds with a mandatory 3-year lock-in period, making them the shortest lock-in option under 80C. ELSS funds invest primarily in equities, offering the potential for inflation-beating returns over the long term. They’re perfect for young investors who can handle some volatility in exchange for higher growth potential.

- National Savings Certificate (NSC): A 5-year government-backed fixed-income instrument that’s particularly popular among risk-averse investors. While returns are modest (currently around 6.8%), the complete safety and tax benefits make NSC attractive for conservative portfolios.

- Tax Saver Fixed Deposits: Offered by most banks with a mandatory 5-year lock-in, these FDs provide guaranteed returns but often at rates lower than other 80C options. They’re suitable for investors who want absolute safety and are satisfied with modest returns.

Insurance and Life Goals

- Life Insurance Premiums: Both term insurance and traditional life insurance premiums qualify for 80C deduction. However, financial experts almost universally recommend term insurance over traditional policies for 80C purposes. Term insurance provides massive coverage at low premiums, leaving you with more money to invest in better-returning 80C options.

- Children’s Education: Tuition fees paid for your children’s education (from kindergarten through university) qualify for 80C deduction. This is particularly valuable for parents with kids in private schools or those pursuing higher education, as these expenses would be incurred anyway.

- Home Loan Principal: The principal component of your home loan EMI qualifies for 80C deduction (the interest component gets separate treatment under Section 24). For young professionals with home loans, this often forms a substantial portion of their 80C limit utilization.

Smart Section 80C Strategy for Young Professionals

If you’re in your 20s or early 30s, you have time on your side – the most valuable asset in wealth creation. Here’s a strategic approach that balances tax savings with long-term wealth building, taking into account your evolving financial needs and risk capacity:

| Investment |

Recommended Amount |

Why It Works for Young Professionals |

Key Benefits |

| EPF (Automatic) |

₹30,000-60,000 |

Forced savings, employer matching, habit formation |

No effort required, guaranteed returns, retirement corpus building |

| ELSS Mutual Funds |

₹50,000-80,000 |

Inflation-beating potential, shortest lock-in, market exposure |

Wealth creation, liquidity after 3 years, professional management |

| PPF |

₹20,000-40,000 |

Tax-free returns, retirement planning, risk-free component |

Triple tax benefit, 15-year wealth compounding, emergency backup |

| Term Insurance |

₹10,000-25,000 |

Essential protection, low cost at young age, family security |

High coverage, increasing human life value, peace of mind |

This diversified approach ensures you’re not putting all your eggs in one basket while maximizing both tax savings and wealth creation potential. The exact allocation should depend on your risk tolerance, existing EPF contributions, and other financial commitments.

Common Section 80C Mistakes to Avoid

Even experienced investors sometimes stumble when it comes to 80C planning. Here are the most costly mistakes that can derail your tax-saving strategy:

- Last-minute investment decisions: The biggest mistake is waiting until March to think about 80C investments. Rushed decisions often lead to poor product choices, like high-commission insurance policies or low-return fixed deposits. Start your 80C planning in April and spread investments throughout the year for better decision-making and rupee-cost averaging in market-linked products.

- Ignoring inflation in long-term planning: Many investors choose fixed-return products like NSC or tax-saver FDs for their entire 80C allocation, not realizing that 6-7% returns barely keep pace with inflation. Over 10-15 years, this can significantly erode purchasing power. Include some equity exposure through ELSS to combat inflation.

- Over-investing in traditional insurance: Insurance companies love to sell traditional life insurance policies by highlighting their 80C benefits. However, these products typically offer poor returns (4-6% annually) and mix insurance with investment inefficiently. Buy term insurance for protection and invest the rest in better-returning 80C options.

- Not tracking the annual limit: Investing more than ₹1.5 lakh in 80C instruments provides no additional tax benefit, yet many investors continue adding money to PPF or buying multiple insurance policies without realizing they’ve exceeded the limit. Track your 80C investments quarterly to optimize allocation.

- Forgetting about lock-in periods: All 80C investments come with lock-in periods ranging from 3 years (ELSS) to 15 years (PPF). Investing money you might need in the short term can create liquidity crunches. Maintain adequate emergency funds outside 80C investments.

Section 80D: Healthcare Tax Benefits Made Simple

In a country where a single serious illness can wipe out years of savings, Section 80D is like having a financial guardian angel. Healthcare costs are rising at nearly twice the rate of general inflation, making health insurance not just a tax-saving tool but an absolute necessity for financial survival. The beauty of Section 80D is that it encourages you to do something you should be doing anyway – protecting yourself and your family against medical emergencies – while providing substantial tax relief.

What makes Section 80D particularly valuable is its recognition of the reality of Indian family structures. Unlike many other tax provisions that focus only on the individual, 80D acknowledges that most Indians feel responsible for their parents’ healthcare and provides additional deductions for covering them as well.

Section 80D Deduction Limits

The deduction limits under Section 80D are structured to provide maximum benefit while encouraging comprehensive family healthcare coverage. The government has thoughtfully designed these limits to account for increasing medical costs with age:

For Individuals Below 60 Years

- Self and family (spouse & children): Up to ₹25,000 annually – This covers health insurance premiums for yourself, your spouse, and dependent children. The limit is per family, not per person, so you need to plan coverage accordingly.

- Parents (below 60 years): Additional ₹25,000 annually – Separate limit for your parents’ health insurance, recognizing that many young professionals support their parents’ healthcare needs.

- Parents (above 60 years): Additional ₹50,000 annually – The doubled limit acknowledges that senior citizens face higher medical costs and premium rates, requiring more substantial financial protection.

- Preventive health check-up: ₹5,000 annually (included within the above limits) – Encourages regular health monitoring, which can prevent costly medical emergencies through early detection.

For Senior Citizens (Above 60 Years)

- Self and spouse: Up to ₹50,000 annually – Recognizing higher healthcare needs and insurance costs for senior citizens.

- Parents: Additional ₹50,000 annually – For very senior parents who require specialized care.

- Maximum total deduction possible: ₹1,00,000 annually – The highest deduction available under 80D, potentially saving up to ₹30,000 in taxes for those in the highest tax bracket.

What Expenses Qualify Under Section 80D?

Section 80D is more comprehensive than many taxpayers realize. It’s not limited to just insurance premiums but covers a broader spectrum of health-related expenses:

- Health insurance premiums: This includes premiums for mediclaim policies, family floater plans, critical illness insurance, and even top-up health insurance plans. The key requirement is that the policy should provide coverage for medical treatment expenses.

- Preventive health check-ups: Annual comprehensive health check-ups, diagnostic tests, and health screenings qualify for deduction even if you don’t have health insurance. This is particularly valuable for young professionals who might skip insurance but should still undergo regular health monitoring.

- Medical expenses for senior citizen parents: If your parents are above 60 and don’t have health insurance, you can claim actual medical expenses paid for their treatment, up to the 80D limits. This provides flexibility for families who prefer paying directly rather than dealing with insurance claims.

Maximizing Section 80D Benefits

Here’s how a strategic approach to Section 80D can provide both maximum tax benefits and optimal healthcare protection:

Real-world Example: Rahul, 28, earns ₹8 lakh annually and is in the 20% tax bracket. He pays ₹15,000 for his comprehensive health insurance (₹5 lakh coverage), ₹12,000 for his wife’s maternity-focused add-on policy, ₹18,000 for his parents’ senior citizen health policy (₹3 lakh coverage), and spends ₹3,000 on annual family health check-ups. His total Section 80D deduction: ₹15,000 + ₹12,000 + ₹18,000 + ₹3,000 = ₹48,000, saving him ₹9,600 in taxes while providing comprehensive family healthcare protection worth ₹13 lakh in total coverage.

Smart Tips for Section 80D Optimization

- Choose comprehensive coverage over tax benefits: The primary goal should always be adequate healthcare protection. Don’t compromise on coverage limits, hospital networks, or policy features just to maximize tax deductions. A policy that saves ₹5,000 in taxes but provides inadequate coverage during a medical emergency is a false economy.

- Include parents in planning early: Health insurance premiums increase significantly with age, and many policies have upper age limits for new entries. Starting coverage for your parents while they’re healthy and younger can save substantial money in the long run while ensuring continuous protection.

- Utilize preventive check-up benefits: The ₹5,000 deduction for preventive health check-ups is often overlooked but can be valuable. Many insurance companies also provide annual check-ups as part of their policies, making this a double benefit.

- Keep meticulous documentation: Maintain all premium receipts, policy documents, and medical bills in both physical and digital formats. The tax department has become increasingly stringent about documentation requirements for 80D claims.

- Consider family floater vs. individual policies: Family floater plans often provide better value for money and higher coverage for the same premium, but individual policies offer dedicated coverage for each family member. Analyze your family’s health profile and premium costs to make the optimal choice.

Beyond 80C and 80D: Other Important Tax Sections

While Section 80C and 80D grab most of the spotlight in tax planning discussions, the Income Tax Act is filled with other valuable provisions that can significantly reduce your tax burden. These lesser-known sections often provide targeted relief for specific situations and can add up to substantial savings when used strategically.

Section 80E: Education Loan Interest

Section 80E is particularly valuable for young professionals who’ve funded their higher education through loans. Unlike most other tax sections that have upper limits, 80E offers unlimited deduction on education loan interest, making it especially beneficial for those with large educational loans from professional courses like MBA, medical, or engineering programs.

- Eligible loans: Loans taken for higher education (post-secondary) for yourself, spouse, children, or any student for whom you are the legal guardian. The loan must be from a recognized financial institution or approved charitable institution. Personal loans or informal borrowings don’t qualify, but educational loans from banks, NBFCs, and government schemes do.

- Deduction period: Maximum 8 years from the beginning of repayment or until the interest is fully paid, whichever is earlier. This extended timeframe recognizes that educational loans often have longer tenures and substantial interest components.

- No upper limit on deduction: Unlike other sections, there’s no cap on the interest amount you can deduct. If you’re paying ₹2 lakh annually in education loan interest, you can deduct the entire amount, potentially saving ₹60,000 in taxes if you’re in the 30% bracket.

- Only interest qualifies: Principal repayment doesn’t get any tax benefit under 80E, but remember that education loan principal can sometimes be claimed under 80C if it’s for skill development courses.

Section 80G: Charitable Donations

Section 80G encourages philanthropy by providing tax deductions for donations to eligible charitable organizations. This section is particularly useful for individuals who regularly contribute to causes they believe in or want to support social initiatives while reducing their tax burden.

- 100% deduction (without limit): Donations to PM CARES Fund, National Defence Fund, and certain government funds qualify for complete deduction without any upper limit. These are considered national priority funds.

- 100% deduction (with limit): Some organizations like Jawaharlal Nehru University offer 100% deduction but are subject to 10% of gross total income limit.

- 50% deduction: Most registered charitable organizations, educational institutions, hospitals, and religious institutions offer 50% deduction on donated amounts. This means if you donate ₹10,000, you can claim ₹5,000 as deduction.

- Documentation requirements: Always obtain official receipts with the organization’s 80G registration number, PAN details, and your PAN number mentioned. Without proper documentation, the entire deduction can be disallowed.

- Cash donation limits: Cash donations above ₹2,000 to any single organization don’t qualify for 80G benefits. Use digital payments, cheques, or demand drafts for larger donations.

Section 80TTA and 80TTB: Interest on Savings

These sections provide relief on interest earned from savings accounts and other specified deposits, recognizing that small savers shouldn’t be heavily taxed on modest interest earnings.

- Section 80TTA (for individuals below 60): Deduction up to ₹10,000 on interest earned from savings accounts with banks, cooperative societies, and post office savings accounts. This effectively makes savings account interest tax-free for most people, as few individuals earn more than ₹10,000 annually in savings interest.

- Section 80TTB (for senior citizens above 60): Much higher deduction of up to ₹50,000 on interest income from savings accounts, fixed deposits, and recurring deposits. This recognizes that senior citizens often depend on interest income for their regular expenses.

- Important note: You cannot claim both 80TTA and 80TTB simultaneously. Senior citizens must choose 80TTB, which is typically more beneficial due to the higher limit.

Section 24: Home Loan Interest

For property owners, Section 24 provides significant relief on home loan interest, encouraging home ownership while supporting the real estate sector. The treatment varies based on how you use the property:

- Self-occupied property: Interest up to ₹2 lakh annually can be deducted. For most home buyers, this limit is sufficient to cover several years of interest payments, especially in the early years when interest forms the major component of EMIs.

- Let-out property: No limit on interest deduction, but it must be set off against rental income first. Any excess loss can be carried forward for 8 years and set off against future house property income.

- Under-construction property: Pre-construction interest can be claimed in five equal installments starting from the year the construction is completed, subject to the ₹2 lakh annual limit for self-occupied properties.

- Multiple properties: If you own multiple properties, you can choose one as self-occupied (eligible for ₹2 lakh interest deduction) and treat others as let-out (unlimited interest deduction against rental income).

House Rent Allowance (HRA): The Urban Professional’s Friend

For the millions of young professionals living in rented accommodations across India’s cities, HRA exemption can be one of the largest tax savers available. It’s particularly valuable in expensive metros like Mumbai, Delhi, and Bangalore, where rent often constitutes 30-40% of take-home salary. Understanding HRA calculation helps you optimize both your salary structure negotiations and tax savings.

The genius of HRA lies in how it recognizes the ground reality of Indian urban life – most young professionals start their careers by renting apartments, often paying substantial amounts that significantly impact their disposable income. The government provides this exemption to ease the burden while encouraging mobility for employment opportunities.

HRA Exemption Calculation

The HRA exemption calculation follows a specific formula designed to ensure that only genuine rent payments get tax benefits while preventing misuse. The exemption is the minimum of three specific amounts:

- Actual HRA received from employer: This is the HRA component mentioned in your salary slip. Some employers structure salaries to maximize HRA within reasonable limits to help employees save taxes.

- 50% of basic salary (metro cities) or 40% of basic salary (non-metro): The government recognizes that metro cities have higher rental costs, hence the higher percentage. Metro cities include Mumbai, Delhi, Chennai, and Kolkata.

- Actual rent paid minus 10% of basic salary: This formula ensures that only the rent exceeding 10% of basic salary qualifies for exemption, preventing trivial rent claims while encouraging reasonable accommodation choices.

HRA Optimization Strategies

Smart HRA planning can save substantial taxes while ensuring you get adequate housing. Here’s how to approach it strategically:

Detailed Example: Priya works in Mumbai with a monthly basic salary of ₹50,000 (₹6 lakh annually) and receives ₹25,000 monthly HRA (₹3 lakh annually). She rents a 1BHK apartment for ₹22,000 monthly (₹2.64 lakh annually). Her HRA exemption calculation works out as follows:

- Actual HRA received: ₹3,00,000

- 50% of basic salary (metro): ₹3,00,000

- Rent minus 10% of basic: ₹2,64,000 – ₹60,000 = ₹2,04,000

The minimum amount is ₹2,04,000, which is completely exempt from tax. This saves Priya approximately ₹40,800 in taxes (assuming 20% tax bracket), making her effective rent only ₹18,800 per month after tax savings.

Advanced HRA Optimization Techniques

- Salary structure negotiation: When joining a new company or during appraisals, negotiate for higher basic salary and HRA components. A higher basic salary increases both your HRA exemption potential and other allowances calculated as percentages of basic salary.

- Documentation maintenance: Keep all rent receipts, rent agreements, and landlord details meticulously organized. For annual rent exceeding ₹1 lakh, your landlord’s PAN number becomes mandatory – ensure this is included in your rent agreement.

- Joint rental strategies: If you’re sharing accommodation with friends or colleagues, ensure the rent agreement clearly mentions your share and that you have individual receipts. This prevents complications during tax scrutiny.

- Family accommodation considerations: You can claim HRA even if you live with parents by paying them rent, but this requires a genuine rent agreement and your parents must declare this as rental income in their tax returns. The arrangement should be at market rates and properly documented.

Leave Travel Allowance (LTA): Tax-Free Family Vacations

LTA is one of the most employee-friendly provisions in the Indian tax code, essentially allowing you to explore the incredible diversity of your own country while getting tax benefits. It recognizes that travel broadens perspectives, strengthens family bonds, and supports the domestic tourism industry – all while providing legitimate tax relief.

What makes LTA particularly attractive is that it encourages domestic tourism and family time, which often take a backseat to work pressures in our fast-paced professional lives. The government’s intent is clear: promote internal tourism, ensure employees take time off for family, and provide tax relief for necessary personal expenses.

LTA Rules and Conditions

LTA comes with specific conditions designed to ensure the benefit serves its intended purpose of promoting domestic travel and family time:

- Frequency limitations: You can claim LTA for two journeys in a block of 4 calendar years. The current block runs from 2022-2025, meaning you can claim for two trips during this period. If you don’t use both trips in a block, they don’t carry forward to the next block.

- Eligible expenses: Only actual travel costs qualify – train tickets, bus fares, air tickets, and other transportation expenses. Hotel bills, food expenses, sightseeing costs, shopping, and local transportation don’t qualify for LTA exemption.

- Family definition: Includes spouse, children, dependent parents, and dependent siblings. The definition is broad enough to cover most family situations, but the dependency criteria must be genuine.

- Domestic travel only: International trips, regardless of expense, don’t qualify for LTA benefits. However, travel to Nepal and Bhutan by land route is considered domestic travel for LTA purposes.

- Common travel requirement: You must travel with your family members to claim LTA for their travel expenses. Individual family member trips don’t qualify unless you’re also traveling.

Smart LTA Planning

To maximize LTA benefits while creating memorable family experiences, consider these strategic approaches:

- Plan expensive routes strategically: Choose destinations that require air travel or long-distance train journeys to maximize the travel cost component. A family trip from Mumbai to Goa by flight can provide higher LTA benefits than a local weekend getaway.

- Time your trips optimally: Use both available trips within the 4-year block. Many employees forget about LTA and lose the benefit entirely. Plan one shorter trip and one longer vacation to spread the benefit across the block period.

- Keep comprehensive documentation: Maintain original tickets, boarding passes, and all travel receipts. Digital tickets should be printed and stored along with booking confirmations that show payment details.

- Consider family size advantage: Larger families can claim higher LTA exemptions since the benefit applies to each traveling family member’s transportation costs. A family of four traveling from Delhi to Kerala by air can claim substantial LTA benefits.

- Coordinate with leave planning: Since LTA encourages actual family time, coordinate your trip planning with your annual leave schedule to ensure you can take meaningful breaks while maximizing tax benefits.

Tax Planning Strategies for Different Life Stages

Tax planning isn’t a one-size-fits-all approach. Your optimal strategy evolves dramatically as you progress through different life stages, with changing income levels, family responsibilities, financial goals, and risk tolerance. What works for a 23-year-old fresh graduate is completely different from what’s appropriate for a 35-year-old parent planning for children’s education and retirement simultaneously.

Fresh Graduates (22-25 years)

This is your golden period for building lifelong tax-saving habits and establishing a strong financial foundation. At this stage, you have the luxury of time and the burden of inexperience – use the former to overcome the latter.

Primary Focus Areas:

- Start SIPs in ELSS funds: Begin systematic investment plans in equity-linked savings schemes with small amounts (₹2,000-5,000 monthly). The power of compounding and rupee-cost averaging will work in your favor over the next 10-15 years. Even if markets are volatile, your young age allows you to ride out the fluctuations.

- Buy term insurance early: Life insurance premiums are lowest when you’re young and healthy. A ₹50 lakh term policy might cost only ₹8,000-12,000 annually at age 23, but the same coverage could cost ₹20,000+ at age 35. The premium difference over 20 years can fund an entire vacation.

- Maximize EPF contributions: If your employer allows voluntary provident fund (VPF) contributions beyond the mandatory 12%, consider utilizing this option. EPF returns are tax-free and typically beat most fixed-income investments.

- Learn tax planning fundamentals: Understand how salary components affect your tax liability. Negotiate with HR for optimal salary structures that include tax-friendly allowances like meal vouchers, communication allowances, and higher HRA components.

- Build an emergency fund: While not directly tax-related, having 6 months of expenses in a liquid fund prevents you from breaking tax-saving investments during emergencies.

Early Career Professionals (25-30 years)

You’re now earning decent money, possibly considering major life decisions like marriage or home buying, and need to balance immediate lifestyle aspirations with long-term financial security.

Strategic Priorities:

- Diversify 80C investments intelligently: Don’t put all your 80C money in one type of investment. A balanced approach might include ₹50,000 in ELSS, ₹30,000 in PPF, ₹40,000 from EPF, and ₹30,000 in term insurance premiums. This provides growth potential, safety, and protection.

- Prioritize comprehensive health insurance: As you take on family responsibilities, health coverage becomes critical. Include your parents in your health insurance planning – premiums are still reasonable when they’re in their 50s but become expensive in their 60s.

- Plan for major expenses: If you’re considering buying a house, understand how home loan principal (80C) and interest (Section 24) will affect your tax planning. The combination can provide substantial tax savings while building asset ownership.

- Optimize salary structure: Negotiate with employers for tax-efficient salary structures. Components like fuel allowance, meal vouchers, and mobile reimbursements can reduce your taxable income significantly.

- Start retirement planning: Consider adding NPS to your portfolio for the additional ₹50,000 deduction under Section 80CCD(1B). Even small contributions now will grow substantially over 30-35 years.

Mid-Career Professionals (30-40 years)

You’re likely in your peak earning years, juggling multiple financial goals simultaneously – children’s education, home loans, parents’ healthcare, and your own retirement planning.

Comprehensive Strategy:

- Maximize home loan benefits: If you own property, fully utilize Section 24 (₹2 lakh interest deduction) and 80C (principal component). For many professionals, home loan components alone exhaust their 80C limit, requiring careful planning of other investments.

- Children’s education planning: Start dedicated education planning beyond tax-saving investments. While tuition fees qualify for 80C, the amount is usually insufficient for comprehensive education planning. Use tax-efficient mutual funds and dedicated education plans.

- Aggressive retirement corpus building: Increase PPF contributions toward the maximum ₹1.5 lakh annually and maximize NPS investments. These long-term, tax-efficient vehicles become crucial as retirement approaches.

- Tax-efficient wealth creation: Look beyond traditional 80C options. Invest in equity mutual funds for long-term goals (benefiting from lower capital gains tax), consider debt funds for medium-term goals, and explore tax-efficient portfolio strategies.

- Estate planning considerations: Ensure adequate life insurance coverage (term insurance) to protect your family’s financial goals. As your income grows, your insurance needs also increase proportionally.

Digital Tools and Technology for Tax Management

The digitization of India’s tax system has revolutionized how we approach tax compliance and planning. What once required multiple visits to CA offices, mountains of paperwork, and weeks of stress can now be managed efficiently from your smartphone. However, the abundance of digital tools can be overwhelming – the key is choosing the right combination that simplifies your tax management without creating new complications.

Government Portals and Apps

The Income Tax Department has made significant investments in digital infrastructure, creating user-friendly platforms that make tax compliance more transparent and efficient:

- Income Tax e-Filing portal (www.incometax.gov.in): This is your primary interface with the tax department. The portal now features a clean, intuitive design that guides you through the filing process step-by-step. Key features include pre-filled forms based on your TDS data, real-time processing status, and integrated payment gateways.

- Annual Information Statement (AIS): This revolutionary feature pre-populates your tax information based on data collected from various sources – your employer’s TDS, bank interest, mutual fund transactions, and property purchases. It significantly reduces manual data entry and helps identify missed income sources.

- TDS reconciliation tools: Track tax deducted by employers, banks, and other entities throughout the year. The portal shows real-time TDS credits, helping you plan year-end tax strategies and identify discrepancies early.

- Refund status tracking: Monitor your refund processing in real-time, from initial filing through final credit to your bank account. The system provides SMS and email alerts at each stage, eliminating the need for repeated status checks.

- e-Verify functionality: Complete your tax filing process entirely online without sending physical documents. Use Aadhaar OTP, net banking, or demat account verification to authenticate your return electronically.

Tax Planning Apps and Software

Third-party applications have filled gaps in government systems, offering enhanced user experiences and additional planning features:

- Tax calculators and comparison tools: Apps like ClearTax, Quicko, and TaxBuddy offer sophisticated calculators that compare old vs. new tax regime scenarios based on your specific income and deduction profile. These tools factor in all available deductions and provide personalized recommendations.

- Investment platforms with tax integration: Platforms like Zerodha Coin, Groww, and Paytm Money integrate tax-saving investments with portfolio management. You can invest in ELSS funds, track your 80C utilization, and monitor returns all from a single dashboard.

- Expense tracking and categorization: Apps like Money View and Walnut automatically categorize expenses and identify tax-deductible items. They can track medical expenses for 80D claims, business expenses for professional deductions, and charitable donations for 80G benefits.

- Document storage and management: Cloud-based solutions like Google Drive, organized specifically for tax documents, or specialized apps like DigiLocker (government-backed) help maintain digital copies of all tax-related documents with easy search and sharing capabilities.

Best Practices for Digital Tax Management

Leveraging technology effectively requires systematic approaches and good digital hygiene:

- Implement quarterly monitoring: Don’t wait until March to check your TDS certificates and tax position. Review your AIS quarterly, reconcile TDS credits, and adjust tax-saving investments based on actual income patterns.

- Create robust document systems: Digitize all tax documents immediately upon receipt. Create folder structures by financial year and category (salary, investments, medical, donations). Use cloud storage with automatic backup for security.

- Automate tax-saving investments: Set up monthly SIPs for ELSS funds, automated PPF contributions, and systematic premium payments for insurance. Automation ensures consistency and prevents last-minute investment decisions.

- Leverage professional consultation technology: Use video conferencing platforms to consult with CAs and tax experts without geographical limitations. Many professionals now offer virtual consultations at competitive rates.

- Enable real-time alerts: Configure SMS and email alerts for all tax-related activities – TDS credits, investment maturity dates, filing deadlines, and refund processing. Proactive alerts prevent missed deadlines and opportunities.

Common Tax Mistakes and How to Avoid Them

Even well-intentioned, educated taxpayers often make costly mistakes that can result in higher tax liability, penalties, or missed opportunities for legitimate savings. These errors usually stem from lack of awareness, poor planning, or misunderstanding of tax provisions rather than any intent to evade taxes.

Filing and Documentation Errors

These seemingly minor mistakes can have major consequences, potentially triggering tax department scrutiny or delaying refund processing:

- Missing critical deadlines: Different deadlines apply to different scenarios – July 31st for most individuals, September 30th for audit cases, and December 31st for revised returns. Set multiple calendar reminders starting two months before deadlines. Late filing attracts penalties even if no tax is due.

- Incorrect bank account details: A single digit error in your bank account number can delay refunds by months. Double-check account numbers, IFSC codes, and ensure the account is active and in your name exactly as per PAN records.

- Missing or incorrect TDS certificates: Collect Form 16 from employers, TDS certificates from banks (Form 16A), and other deductors promptly. Verify that PAN numbers, amounts, and financial year details are correct before filing returns.

- Wrong ITR form selection: Using ITR-1 when you have capital gains or business income can invalidate your return. ITR-1 is only for salary and house property income; ITR-2 covers capital gains; ITR-3 is for business income. When in doubt, use a higher numbered form.

- Inadequate supporting documentation: Maintain original receipts, investment proofs, and medical bills for at least 8 years. Digital scans should be clear and complete. Missing documentation can lead to disallowance of claimed deductions during scrutiny.

Investment and Planning Mistakes

These strategic errors can significantly impact long-term wealth creation while reducing tax efficiency:

- Last-minute investment panic: Waiting until March to make tax-saving investments often leads to poor product choices driven by desperation rather than analysis. Commission-hungry agents exploit this panic to sell suboptimal products. Start tax planning in April and spread investments throughout the year.

- Ignoring inflation in long-term planning: Choosing fixed-return instruments like NSC or tax-saver FDs for the entire 80C allocation might provide safety but fails to protect purchasing power over 10-15 years. Include equity exposure through ELSS to combat inflation.

- Over-reliance on traditional insurance: Mixing insurance and investment through traditional life insurance policies typically provides poor returns (4-6% annually) and inadequate coverage. Buy separate term insurance for protection and invest in better-returning 80C options for wealth creation.

- Exceeding beneficial limits: Investing more than ₹1.5 lakh in 80C instruments or more than the applicable limits in other sections provides no additional tax benefit. Track your deduction utilization quarterly and redirect excess funds to other tax-efficient investments.

- Neglecting health insurance adequacy: Buying minimal health coverage just for 80D tax benefits can prove catastrophic during medical emergencies. Prioritize adequate coverage over tax savings – a ₹5 lakh policy that saves ₹5,000 in taxes is useless against a ₹10 lakh medical bill.

Regime Selection Confusion

The choice between old and new tax regimes confuses many taxpayers, often leading to suboptimal decisions that cost thousands in unnecessary taxes:

| Evaluation Factor |

Old Regime Advantage |

New Regime Advantage |

Decision Guidelines |

| Available Deductions |

High (80C, 80D, HRA, home loan) |

Minimal deductions allowed |

Calculate total deductions vs. rate differential |

| Tax Rate Structure |

Higher basic rates |

Lower rates across slabs |

Compare effective tax rate after deductions |

| Complexity Level |

More planning and documentation required |

Simplified calculation and filing |

Consider time and effort investment |

| Best Suited For |

High deduction utilizers, home owners |

Simple income, minimal deductions |

Analyze personal financial situation annually |

| Flexibility |

Can switch annually (for salary earners) |

Same switching flexibility |

Re-evaluate choice each financial year |

Key Decision Framework: Calculate your tax liability under both regimes based on your actual deductions. If your total deductions exceed ₹2 lakh annually, the old regime typically provides better outcomes. However, this threshold varies based on income level and specific deduction mix.

Advanced Tax Planning Concepts

As your income grows and financial situation becomes more complex, basic tax-saving strategies may not be sufficient. Advanced tax planning involves sophisticated techniques that require deeper understanding but can provide substantial benefits for high-income earners.

National Pension System (NPS)

NPS represents one of the most powerful combinations of tax benefits and long-term wealth creation available to Indian taxpayers. Beyond the standard 80C limit, NPS offers additional deductions that can significantly reduce tax liability while building retirement corpus:

- Section 80CCD(1B) – Additional ₹50,000 deduction: This is over and above the ₹1.5 lakh 80C limit, providing extra tax relief specifically for retirement planning. For someone in the 30% tax bracket, this translates to ₹15,000 annual tax savings plus long-term wealth creation.

- Section 80CCD(2) – Employer contribution benefits: Employer contributions up to 10% of basic salary qualify for separate deduction. Many progressive companies now offer NPS as part of their benefits package, providing both immediate tax relief and future retirement security.

- Professional fund management: NPS offers exposure to equity, corporate bonds, and government securities through professional fund managers, with costs significantly lower than most mutual funds. The equity exposure can help combat inflation over the long investment horizon.

- Systematic retirement planning: Unlike other 80C investments that might be withdrawn for various needs, NPS is specifically designed for retirement, ensuring disciplined long-term wealth accumulation when you need it most.

- Partial withdrawal flexibility: After three years, you can withdraw up to 25% of your contributions for specific purposes like higher education, marriage, or medical emergencies, providing some liquidity while maintaining long-term focus.

Tax-Efficient Mutual Fund Strategies

Beyond ELSS funds, sophisticated mutual fund strategies can optimize your tax liability while building wealth across different time horizons:

- Equity fund taxation advantages: Equity mutual funds held for more than one year qualify for long-term capital gains tax of only 10% on gains exceeding ₹1 lakh annually. This is significantly lower than the income tax rates, making equity funds highly tax-efficient for wealth creation.

- Debt fund indexation benefits: Debt mutual funds held for more than three years benefit from indexation, which adjusts your purchase cost for inflation, significantly reducing taxable gains. This makes debt funds more tax-efficient than fixed deposits for medium-term goals.

- Systematic Transfer Plans (STP): STP allows you to gradually move money from debt to equity funds, optimizing asset allocation while managing market volatility. This strategy can help in tax planning by controlling the timing of capital gains realization.

- Systematic Withdrawal Plans (SWP): For retired individuals or those needing regular income, SWP provides tax-efficient cash flow by withdrawing a fixed amount monthly, with each withdrawal treated partially as capital gains (taxed favorably) and partially as return of capital (not taxed).

- Tax loss harvesting: Strategically booking losses in underperforming investments to offset gains in profitable ones, thereby reducing overall capital gains tax liability. This requires active portfolio monitoring and rebalancing.

Business and Professional Income

For freelancers, consultants, and business owners, additional tax planning opportunities exist beyond those available to salaried individuals:

- Presumptive taxation schemes: Small businesses with turnover below specified limits can opt for presumptive taxation under Sections 44AD, 44ADA, or 44AE, significantly simplifying tax calculation and compliance while providing guaranteed profit margins for tax purposes.

- Legitimate business expense deductions: Home office expenses, professional development costs, business-related travel, equipment purchases, and software subscriptions can be claimed as business expenses, reducing taxable income substantially.

- Advance tax planning: Business owners must pay advance tax quarterly, which requires careful cash flow planning and income estimation. Proper advance tax planning prevents interest charges and ensures smooth cash flow management.

- GST and income tax coordination: Ensuring your GST filings align with income tax declarations prevents discrepancies that could trigger scrutiny. Maintaining consistent accounting practices across both tax systems is crucial.

- Retirement planning for business owners: Self-employed individuals can contribute up to 20% of income to NPS, significantly higher than the limits for salaried employees, providing substantial retirement planning benefits.

Staying Updated: Tax Law Changes and Compliance

Tax laws in India are dynamic, with changes introduced regularly through annual budgets, amendments, and clarifications. What worked perfectly for your tax planning last year might become suboptimal or even invalid this year. Staying updated isn’t just about compliance – it’s about identifying new opportunities and avoiding costly mistakes that arise from outdated information.

The challenge for most taxpayers is filtering relevant information from the overwhelming amount of tax-related news and analysis. Every budget announcement generates hundreds of articles, but only a fraction directly impacts individual taxpayers. Developing reliable information sources and understanding which changes affect your specific situation is crucial for effective tax planning.

Annual Budget Impact

Every Union Budget, typically presented on February 1st, brings potential changes that can significantly affect your tax planning strategy. Understanding how to evaluate and respond to these changes can save substantial money and prevent compliance issues:

- Tax slab modifications: Changes in tax rates or income thresholds can dramatically alter your optimal tax regime choice. For example, recent budgets have consistently lowered rates in the new regime while keeping old regime rates unchanged, gradually shifting the equilibrium point where new regime becomes beneficial.

- Deduction limit changes: Modifications to Section 80C limits, introduction of new deduction sections, or changes in health insurance deduction limits under 80D can affect your investment allocation strategy. The government occasionally increases these limits to account for inflation or policy priorities.

- New tax-saving instruments: Governments periodically introduce new investment options with tax benefits, like the initial introduction of ELSS or more recent NPS enhancements. Early adoption of beneficial new instruments can provide significant advantages.

- Compliance and procedural changes: Updates to filing procedures, documentation requirements, deadline modifications, or digital filing enhancements can affect how you manage your tax obligations. The shift from physical to digital-first filing is an ongoing example of such changes.

- Sector-specific changes: Sometimes budget changes specifically benefit certain professions or income sources – changes in capital gains taxation, professional tax rates, or sector-specific deductions can create new planning opportunities.

Reliable Information Sources

In an era of information overload, identifying trustworthy, accurate sources for tax information becomes critical. Misinformation can lead to costly mistakes or missed opportunities:

- Official government sources: The Income Tax Department website (incometax.gov.in) publishes all official notifications, circulars, and clarifications. This should be your primary source for authoritative information. The department also maintains active social media accounts that provide timely updates and clarifications.

- Professional publications and journals: Publications like Taxmann, CCH, and other professional tax journals provide detailed analysis of changes, practical implications, and expert commentary. These sources offer deeper insights than general financial media.

- Certified professional guidance: Chartered Accountants, tax consultants, and financial planners who specialize in taxation provide personalized advice based on your specific situation. Their expertise becomes particularly valuable for complex scenarios or significant financial decisions.

- Reputable financial media: Established financial newspapers, magazines, and websites like Economic Times, Business Standard, and LiveMint provide reliable coverage of tax changes with practical implications for individual taxpayers.

- Professional webinars and seminars: Many CA firms and financial institutions conduct post-budget analysis sessions that explain changes in practical terms. These sessions often include Q&A segments that address common taxpayer concerns.

Frequently Asked Questions

These are the most common questions that arise during tax planning discussions, based on real experiences of thousands of taxpayers across different income levels and life situations. Understanding these nuances can prevent costly mistakes and optimize your tax strategy.

Can I switch between old and new tax regimes every year?

For salaried individuals, yes, you have the flexibility to choose between old and new tax regimes annually during tax filing. This flexibility allows you to optimize based on your changing financial circumstances – perhaps you get married and start paying rent (favoring old regime due to HRA), or maybe you pay off your home loan and have fewer deductions (potentially favoring new regime).

However, if you have business or professional income, you can only switch regimes once during your lifetime, making this decision much more permanent and requiring careful long-term analysis. For such taxpayers, the choice should consider not just current circumstances but projected income and deduction patterns over many years.

The key is to calculate both scenarios every year during tax filing, considering all your deductions, exemptions, and income sources. Your optimal choice might change as your financial situation evolves, and this annual flexibility for salaried individuals is valuable for optimization.

What happens if I exceed the Section 80C limit of ₹1.5 lakh?

Investments beyond ₹1.5 lakh under Section 80C-eligible instruments don’t provide additional tax benefits for that financial year. However, these excess investments aren’t wasted – they continue to serve their primary purpose of building wealth toward your financial goals.

For example, if you invest ₹2 lakh in PPF during a year, only ₹1.5 lakh counts toward 80C deduction, but the entire ₹2 lakh earns tax-free returns and builds your retirement corpus. The key is planning your 80C investments strategically throughout the year to stay within limits while maximizing tax efficiency.

Many taxpayers make this mistake by not tracking their EPF contributions (which automatically count toward 80C) and then over-investing in other 80C instruments. Monitor your 80C utilization quarterly and redirect excess funds to other tax-efficient investments or financial goals once you approach the limit.

Is health insurance mandatory for Section 80D benefits?

While health insurance isn’t mandatory by law, it’s highly recommended for comprehensive financial protection. Section 80D deduction is available only when you actually pay health insurance premiums or eligible medical expenses – you can’t claim the deduction without real expenditure.

The philosophy should be: buy health insurance primarily for protection against medical emergencies, with tax benefits being a valuable secondary advantage. A ₹25,000 health insurance premium that saves ₹5,000-7,500 in taxes while providing ₹5-10 lakh medical coverage is excellent value. Don’t let tax savings drive inadequate coverage decisions.

For senior citizen parents without insurance, you can claim actual medical expenses under 80D, but insurance usually provides better protection and peace of mind than self-insuring against medical costs.

How do I claim HRA exemption if I live with parents?

You can legitimately claim HRA exemption by paying rent to your parents, but this arrangement requires careful structuring to withstand tax scrutiny. Create a formal rent agreement at market rates, make payments through bank transfers (not cash), and ensure your parents declare this rental income in their tax returns.

The arrangement must be genuine – the rent should be reasonable for your location and accommodation type. If you’re paying ₹50,000 monthly rent for a room in a small town, it might raise questions. Document the arrangement properly and maintain all payment records.

This strategy works particularly well when your parents are in lower tax brackets than you, as the rental income tax in their hands might be less than your HRA exemption benefit. However, ensure compliance with all documentation requirements and genuine transaction principles.

What documents do I need for tax filing?

Comprehensive documentation is crucial for smooth tax filing and potential future scrutiny. Essential documents include:

Income Documents: Form 16 from employer, salary certificates, bank interest certificates (Form 16A), dividend statements, rental income agreements, and business income records.

Investment Proofs: PPF account statements, ELSS investment receipts, insurance premium receipts, NSC certificates, bank fixed deposit receipts, and home loan principal payment certificates.

Expense Documentation: Health insurance premium receipts, medical bills for 80D claims, donation receipts with 80G details, education loan interest certificates, and professional expense bills for business income.

Property Documents: Home loan interest certificates, property tax receipts, rent agreements and receipts for HRA claims, and property purchase/sale documents for capital gains.

Maintain both physical and digital copies, organized by financial year and category. Cloud storage with automatic backup ensures you never lose critical documents.

Can I claim both EPF and PPF under Section 80C?

Yes, both Employee Provident Fund (EPF) and Public Provident Fund (PPF) contributions qualify under Section 80C and count toward the combined ₹1.5 lakh annual limit. This combination is actually quite popular among taxpayers as it provides both forced savings through salary deduction (EPF) and voluntary retirement planning (PPF).

Many professionals find that their EPF contributions (12% of basic salary) already consume ₹40,000-80,000 of their 80C limit, leaving room for ₹70,000-1,10,000 in PPF contributions. This combination provides excellent diversification between employer-sponsored retirement savings and individual retirement planning.

The key is tracking your total 80C utilization across all instruments to ensure you don’t exceed the beneficial limit while maintaining optimal allocation between different investment types.

How does tax calculation work for variable income like bonuses?

All income components – salary, bonuses, incentives, overtime payments, and perquisites – are aggregated to calculate your total annual income. Tax is then calculated on this combined amount using applicable slabs, not separately on each component.

Your employer typically estimates your annual income including expected bonuses and adjusts TDS (Tax Deducted at Source) throughout the year. When you receive a large bonus, additional TDS is deducted to account for the higher income pushing you into higher tax brackets.

This system can sometimes result in excess TDS if bonuses are lower than expected, leading to tax refunds. Conversely, if bonuses exceed estimates, you might owe additional tax. Monitor your Form 16 and calculate your tax liability annually to understand your position and plan accordingly.

What’s the penalty for late tax filing?

Late filing penalties are structured to encourage timely compliance while not being excessively punitive for genuine delays. The penalty structure depends on how late you file and your income level:

Filing between due date and December 31st: Penalty of ₹1,000 (or ₹1,000 maximum if total income is up to ₹5 lakh).

Filing after December 31st: Penalty increases to ₹10,000 (still capped at ₹1,000 if total income is up to ₹5 lakh).

Interest on unpaid taxes: Separately, if you owe taxes, interest at 1% per month applies from the original due date until payment, regardless of when you file your return.

The penalty applies even if you don’t owe any tax, so file on time even if you’re expecting a refund. For high earners, the ₹10,000 penalty for very late filing can be substantial, making timely filing economically important beyond compliance considerations.

Should I hire a CA or file taxes myself?

This decision depends on your income complexity, available time, and comfort with tax concepts. For straightforward salary income with standard deductions (80C, 80D, HRA), self-filing using online platforms is often feasible and cost-effective. Modern tax software and the government’s simplified filing process make DIY filing accessible for most salaried professionals.

Consider professional help if you have multiple income sources (salary plus rental or business income), significant capital gains, complex investment portfolios, or income exceeding ₹50 lakh (requiring audit). The complexity threshold is individual – some people handle multiple income sources comfortably, while others prefer professional assistance even for basic returns.

Professional fees typically range from ₹2,000-10,000 for individual returns, often justifying the cost through time savings, accuracy, and peace of mind. Many CAs also provide year-round tax planning advice, making the relationship valuable beyond just filing season.

How do I track my tax refund status?

The Income Tax Department provides multiple convenient channels for refund tracking, making the process transparent and accessible:

Online tracking: Use the e-filing portal (incometax.gov.in) with your PAN and acknowledgment number from your filed return. The system shows real-time status from processing through bank credit.

Mobile apps: The official “Income Tax India” mobile app provides refund tracking along with other tax services, allowing easy status checks from anywhere.

SMS and email alerts: Register for automatic notifications that update you at each processing stage – return processing, refund generation, and bank credit.

Automated helpline: Call the tax department’s automated phone service for refund status using your PAN and acknowledgment number.

Refunds typically process within 45-60 days for electronically filed returns without discrepancies. Delays usually occur due to mismatched bank details, pending verifications, or returns selected for scrutiny.

Can I revise my tax return after filing?

Yes, you can file a revised return if you discover errors or omissions in your original return, but specific conditions and timelines apply. A revised return can be filed within the due date for filing or before completion of assessment, whichever is earlier.

Valid reasons for revision: Missed income sources, incorrect deduction claims, errors in tax calculations, or changes in regime choice (old vs. new). You can also revise to claim missed deductions or exemptions that reduce your tax liability.

Limitations: You cannot revise a return merely to claim additional refunds in certain circumstances, and revised returns undergo more scrutiny. Each revision must be based on genuine errors or omissions, not optimization attempts.

Process: File the revised return using the same ITR form, clearly marking it as “revised” and referencing the original acknowledgment number. The revised return supersedes the original return completely.

While revision is possible, it’s better to file accurately the first time through careful preparation and review before submission.

What’s the difference between tax deduction and tax exemption?

Understanding this distinction is crucial for optimal tax planning, as the two concepts work differently in your tax calculation and have different strategic implications:

Tax Deductions: These reduce your taxable income, and you pay tax on the remaining amount. Section 80C investments, health insurance premiums under 80D, and home loan interest under Section 24 are deductions. If you’re in the 20% tax bracket and claim ₹1 lakh in deductions, you save ₹20,000 in taxes.

Tax Exemptions: These are portions of income completely excluded from tax calculation. HRA exemption, LTA exemption, and specific allowances are exemptions. Exempt income never enters your taxable income calculation.

Strategic Implications: Exemptions are generally more valuable than deductions because they provide 100% relief, while deductions provide relief only at your marginal tax rate. A ₹50,000 HRA exemption saves the same taxes as ₹50,000 in your tax bracket, while a ₹50,000 deduction saves only your tax rate percentage of that amount.

Both are legitimate tax planning tools, but understanding their mechanics helps you prioritize which benefits to claim and how to structure your finances for maximum tax efficiency.

IMPORTANT UPDATE NOTICE (February 2025): This guide has been updated to reflect the major tax changes announced in Union Budget 2025, effective from FY 2025-26 (April 1, 2025). The new tax regime has been significantly enhanced, making income up to ₹12 lakh effectively tax-free. While the core concepts and strategies in this guide remain valid, please verify current tax rates and limits before making investment decisions, as tax laws are subject to change.

Understanding India’s tax system empowers you to make informed financial decisions while staying compliant with legal requirements. The recent Budget 2025 changes represent a landmark shift toward simplification and relief for middle-income taxpayers. The journey from tax-anxious to tax-savvy isn’t just about saving money – it’s about developing a comprehensive understanding of how your financial decisions interconnect with the broader economic system.

Start with the fundamental concepts outlined in this guide, gradually implement advanced strategies as your income and complexity grow, and remember that effective tax planning is a year-round activity, not a March marathon. With proper knowledge, systematic planning, and regular review of your strategy, you can optimize your taxes while building substantial long-term wealth.

The Indian tax system, despite its apparent complexity, offers numerous legitimate opportunities for tax optimization when understood properly. Use these tools wisely, stay updated with changes, maintain proper documentation, and don’t hesitate to seek professional guidance when your situation becomes complex. Your future financial success depends not just on how much you earn, but on how efficiently you manage what you earn – and taxes play a crucial role in that equation.

If you’re reading this, chances are you’re one of millions of Indians who feel overwhelmed by personal finance. Maybe you’re earning well but don’t know where your money goes each month. Perhaps you’re confused by the endless investment options everyone keeps talking about. Or maybe you’re simply tired of keeping your savings in a bank account earning 3% while inflation eats away at your purchasing power.

Here’s what most Indians don’t realize: personal finance isn’t rocket science, but it is uniquely Indian. The strategies that work in the US or Europe often fall flat here because they don’t account for our joint family systems, our emotional relationship with gold and real estate, or the complexities of our tax system.

This comprehensive guide will walk you through everything you need to know about managing money in India. We’ll cover the basics that schools never taught you, dive deep into investment options that actually make sense for Indian families, and help you build a financial foundation that can weather any storm.

The Foundation: Understanding Your Financial Health

Before we dive into investments and tax planning, let’s get your financial house in order. Think of this as your financial health checkup – we need to know where you stand before charting the path forward.

Creating Your Personal Balance Sheet

Most Indians have never calculated their net worth, but it’s simpler than you think. Your net worth is everything you own (assets) minus everything you owe (liabilities).

Assets include:

- Cash in savings and current accounts

- Fixed deposits and recurring deposits

- Investment in mutual funds, stocks, bonds

- EPF and PPF balances

- Real estate (current market value, not purchase price)

- Gold and jewelry (current market value)

- Insurance policies with cash value

Liabilities include:

- Home loan outstanding

- Personal loans

- Credit card debt

- Car loans

- Education loans

- Money borrowed from family or friends

Here’s a reality check: if your net worth is negative, you’re not alone. According to recent surveys, nearly 40% of urban Indians have more debt than assets. The good news? Recognizing this is the first step toward fixing it.

The 50-30-20 Rule (Desi Version)

The classic 50-30-20 budgeting rule needs some Indian modifications. Here’s what works better for most Indian families:

50% for Needs (Indian Reality: Often 60-65%)

- Rent or EMI

- Groceries and household expenses

- Utilities (electricity, gas, water, internet)

- Transportation

- Insurance premiums

- Family support (this is uniquely Indian and perfectly valid)

30% for Wants (Indian Reality: Often 20-25%)

- Dining out and entertainment

- Shopping and lifestyle expenses

- Hobbies and subscriptions

- Vacations

20% for Savings and Investments (Target: Increase to 30%)

- Emergency fund

- Long-term investments

- Retirement planning

- Children’s education fund

Don’t worry if your current split doesn’t match this. Most Indians start with 70-25-5, and that’s okay. The goal is gradual improvement, not perfection.

Emergency Fund: Your Financial Safety Net

Let’s talk about something that could save your financial life: an emergency fund. The COVID-19 pandemic taught us harsh lessons about job security and unexpected expenses. Yet, studies show that less than 25% of Indians have adequate emergency savings.

How Much Do You Really Need?

The standard advice is 6 months of expenses, but let’s be more nuanced:

If you’re a salaried employee with stable income: 6 months of expenses

If you’re self-employed or in sales: 9-12 months of expenses

If you’re the sole earner in your family: 12 months of expenses

If you have aging parents or dependents with health issues: Add 3-6 months extra

For example, if your monthly expenses are ₹50,000, aim for ₹3-6 lakh in your emergency fund.

Where to Keep Your Emergency Fund

This money needs to be easily accessible, not locked away in fixed deposits or investments. Here are your best options:

Savings Bank Account (40% of emergency fund)

- Instant access

- Choose high-yield savings accounts from banks like Kotak 811, IDFC First, or DBS

- Current rates: 6-7% annually

Liquid Mutual Funds (40% of emergency fund)

- Better returns than savings accounts (7-8% annually)

- Money available within 24 hours

- Good options: Axis Liquid Fund, ICICI Prudential Liquid Fund

Sweep-in Fixed Deposits (20% of emergency fund)

- Automatic conversion from savings to FD

- Higher interest rates

- Available with most major banks

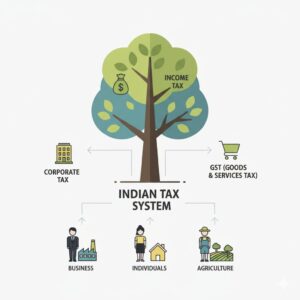

Understanding the Indian Tax System

Taxes in India can seem like a maze, but understanding the basics can save you lakhs over your lifetime. Let’s break down what every Indian taxpayer needs to know.

Income Tax Slabs and Your Options

India now offers two tax regimes, and choosing the right one can significantly impact your take-home salary.

Old Tax Regime (with deductions):

- Up to ₹2.5 lakh: No tax

- ₹2.5 lakh to ₹5 lakh: 5%

- ₹5 lakh to ₹10 lakh: 20%

- Above ₹10 lakh: 30%

- Plus: Access to deductions under Section 80C, 80D, etc.

New Tax Regime (lower rates, fewer deductions):

- Up to ₹3 lakh: No tax

- ₹3 lakh to ₹6 lakh: 5%

- ₹6 lakh to ₹9 lakh: 10%

- ₹9 lakh to ₹12 lakh: 15%

- ₹12 lakh to ₹15 lakh: 20%

- Above ₹15 lakh: 30%

- But: Limited deductions available

Tax-Saving Strategies That Actually Work

Section 80C Investments (₹1.5 lakh limit)

- ELSS Mutual Funds: Best option for wealth creation with 3-year lock-in

- PPF: 15-year lock-in but tax-free returns

- EPF: Automatic for salaried employees

- Life Insurance: Only if you need insurance, not for investment

- NSC/Tax Saver FDs: Safe but low returns

Section 80D (Health Insurance)

- ₹25,000 for self and family

- Additional ₹25,000 for parents (₹50,000 if parents are senior citizens)

- ₹5,000 for preventive health checkups

HRA Optimization

If you’re paying rent, ensure you’re claiming HRA properly. Many employees miss out on significant tax savings here. The exemption is the minimum of:

- Actual HRA received

- 50% of salary (40% for non-metro cities)

- Rent paid minus 10% of salary

The Indian Banking System: Making It Work for You

Banking in India has evolved dramatically, but many people still aren’t making the most of available options. Let’s change that.

Choosing the Right Bank Accounts

Salary Accounts vs. Savings Accounts

Most people stick with their salary account bank out of convenience, but this could be costing you money. Here’s what to consider:

Best Savings Accounts for High Returns:

- Kotak 811: Up to 7% interest, zero balance

- IDFC First Bank: Up to 7% interest, ₹25,000 minimum balance

- DBS Bank: Up to 7% interest, digital-first experience

- IndusInd Bank: Up to 6.75% interest, good for high-balance customers

Best Banks for Overall Banking:

- HDFC Bank: Excellent customer service, wide ATM network

- ICICI Bank: Strong digital platform, good for tech-savvy users

- Axis Bank: Good for credit cards and investment services

- SBI: Largest network, government backing, lower fees

Credit Cards: Your Financial Tool, Not a Trap

Credit cards get a bad reputation in India, but used wisely, they’re powerful financial tools. Here’s how to make them work for you:

Best Credit Cards by Category:

- Cashback: Amazon Pay ICICI, Flipkart Axis Bank

- Rewards: HDFC Regalia, Axis Magnus

- Travel: HDFC Diners Club, American Express Gold

- Fuel: HDFC MoneyBack, Indian Oil Axis Bank

- First Card: Lifetime free options from SBI, ICICI

Credit Card Golden Rules:

- Never pay just the minimum amount due

- Set up auto-pay for full amount

- Keep credit utilization below 30%

- Pay before the due date, not on the due date

- Check your credit score regularly (free on apps like CRED, Paisabazaar)

Investment Options in India: Building Wealth Systematically

Now we come to the heart of wealth building. India offers numerous investment options, but not all are suitable for everyone. Let’s understand what works and what doesn’t.

Mutual Funds: The Game Changer for Indian Investors

Mutual funds have revolutionized investing for middle-class Indians. With SIPs (Systematic Investment Plans), you can start investing with as little as ₹500 per month.

Types of Mutual Funds and When to Use Them:

Equity Funds (For Long-term Wealth Creation)

- Large Cap Funds: Stable, lower risk, 10-12% annual returns

- Mid Cap Funds: Higher growth potential, higher volatility, 12-15% annual returns

- Small Cap Funds: Highest risk and return potential, 15-18% annual returns

- Multi Cap/Flexi Cap: Balanced approach, good for beginners